A seamless financial journey

for your law firm.

Free Obligation-Free Pilot!

Try Otterz, the AI-powered platform that automates bookkeeping and tax compliance. Gain clarity on your finances and see how our zero-risk pilot can help your business grow — completely free!

Why Otterz for your law firm?

From legal trust accounting to expense management and tax compliance services, Otterz provides comprehensive solutions to ensure compliance, track billable hours, minimize tax liabilities,

and generate tailored financial reports for law firms.

Unparalleled accuracy

Otterz delivers precise, consistent financial management tailored to the legal industry. Ensure compliance with trust account regulations and avoid costly errors with AI-powered accuracy that maintains your firm’s financial integrity.

Time-efficient

Automating financial workflows allows your firm to focus on billable hours rather than time-consuming administrative tasks. With streamlined accounting and tax management, your team can prioritize client service

and case work.

Fuels profits

Through automation and enhanced financial accuracy, Otterz helps lower operational costs and reduce overhead. With real-time insights and efficient workflows,

your firm can cut expenses and maximize revenue without adding more billable hours.

Cost-effective

Law firms often delegate lower-billable tasks to save time, but profitability isn't just about billing more hours; it's about cutting costs. Otterz streamlines workflows and automates time-consuming tasks, helping you enhance client service and boost profitability.

What we offer?

Bookkeeping

services

Savings of up to 74%

Otterz offers a full range

of small business & startup bookkeeping services with

a dedicated accountant

to ensure that your

financial records are accurate, current,

and well-organized.

Tax advisory &

filing

Costs slashed to Zero

Expert year-round tax accounting: precision for your business taxes.

Tailored tax-saving strategies for every challenge you're experiencing.

CFO

services

Smarter financial decisions

Enhance your financial strategy, uncover growth opportunities, and make confident decisions with guidance from an experienced CFO.

AI-powered

Platform

Free financial management platform

Business insights, expert support from your dedicated accountant, and reinforcement learning-based AI capabilities, available on web, iOS, and Android.

Why using Otterz platform?

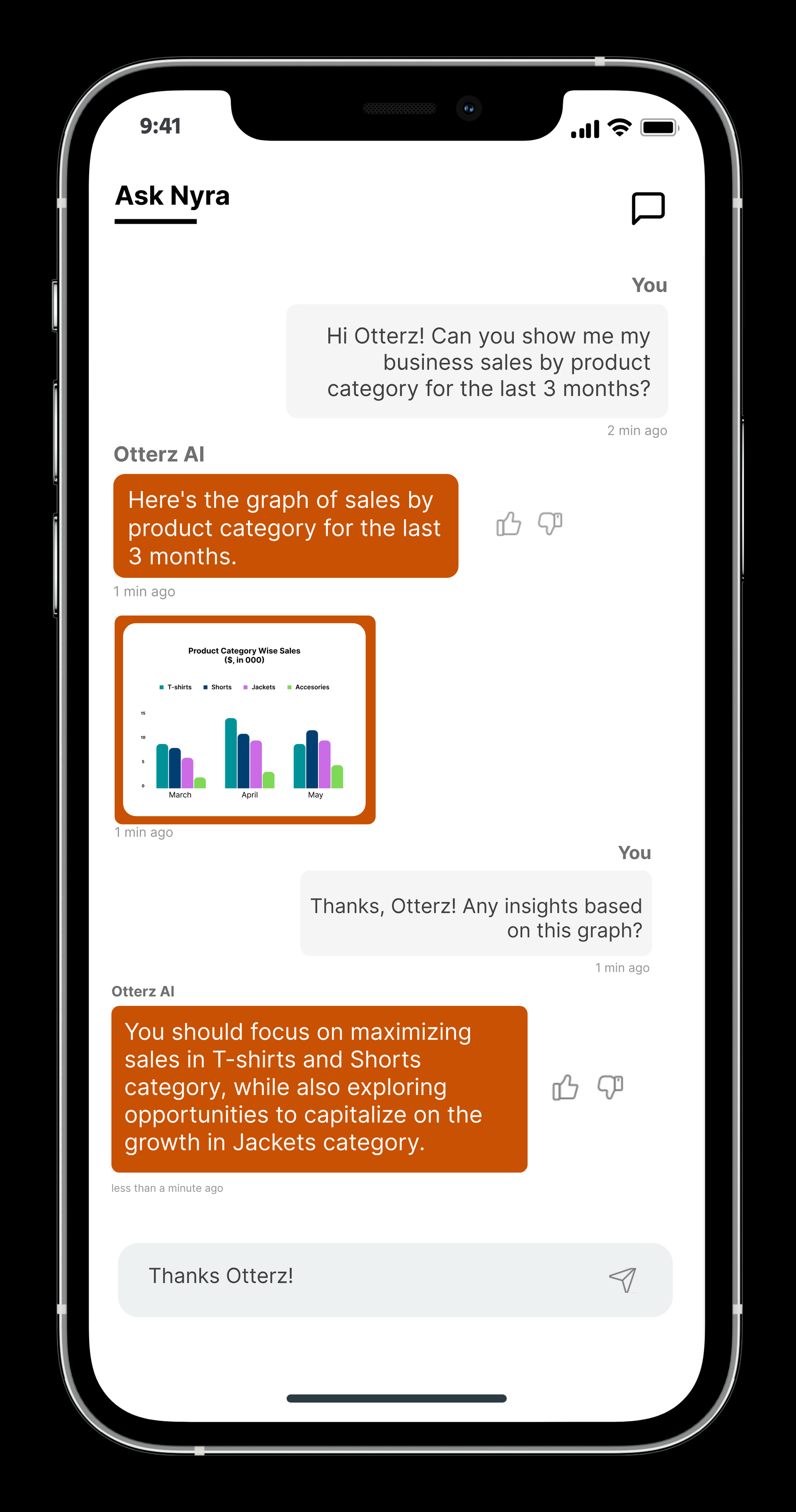

Transaction monitoring

In the background, Nyra keeps a sharp eye on every transaction, catching any inconsistencies or unfamiliar details to ensure flawless accuracy.

AI-powered dashboard

Never miss a bit! View all your cash and card balances from integrated accounts in one place with Otterz. Get the full financial picture and seize every opportunity.

Instant decision-making

With Nyra’s smart technology and advanced features, gain instant clarity on your business for fast, informed decision-making.

Assists your dedicated accountant

Nyra assists your dedicated accountant in reconciling accounts, and classifying transactions to keep your books updated in real-time faster and with higher precision.

State Bar compliant

Otterz is a cutting-edge platform designed to meet State Bar compliance requirements, ensuring that all legal practices adhere to the highest regulatory standards. Our robust features include trust reconciliation, allowing legal professionals to manage client funds with accuracy and transparency.

Always available

Nyra’s at your service 24/7, ready to tackle your questions anytime, anywhere.

See what Otterz can do for you

You're one call away to save your business thousands.

All you need to do is follow three simple steps.

Schedule your consultation call

Proposal

& agreement

Following the consultation, we will finalize the proposal. Upon mutual agreement, you will proceed to sign the service agreement.

Onboarding

& set up

Our team will guide you through the setup process, including:

- Integrating your QuickBooks and Plaid accounts with our platform

- Setting up your dedicated accountant

- Conducting a thorough, free audit to reclassify transactions for compliance and efficiency

You're all

set!

Schedule a kickoff meeting with your dedicated accountant to explore financial strategies and begin using our services.

Contact us now to see how Otterz

can transform your business.

Bookkeeping and tax services for law firms

Frequently Asked Questions