Meet Nyra,

the world's first AI accountant

Step into a new era for AI in accounting

Web, iOS and android platform included for free in all our accounting plans

Get the clear beat of your business

with sharp, actionable insights.

Nyra is your AI accountant that seamlessly analyzes your financial data in real-time, offering clear, actionable insights and streamlining your accounting tasks to keep your business pulse in perfect sync.

Why should businesses adopt AI powered technology?

Cost-effective

A staggering 93% of small business owners acknowledge that AI tools

are cost-effective, driving savings

and boosting profitability.*

Time-efficient

41% of small businesses have leveraged AI to reallocate their time and that of their employees towards more valuable tasks.*

Fuels profits

Businesses utilizing AI

experienced a 12-point rise in their probability of profit growth compared to those not using AI.*

How Nyra impacts your business?

Transaction monitoring

In the background, Nyra keeps a sharp eye on every transaction, catching any inconsistencies or unfamiliar details to ensure flawless accuracy.

AI-powered dashboard

Never miss a bit! View all your cash and card balances from integrated accounts in one place with Otterz. Get the full financial picture and seize every opportunity.

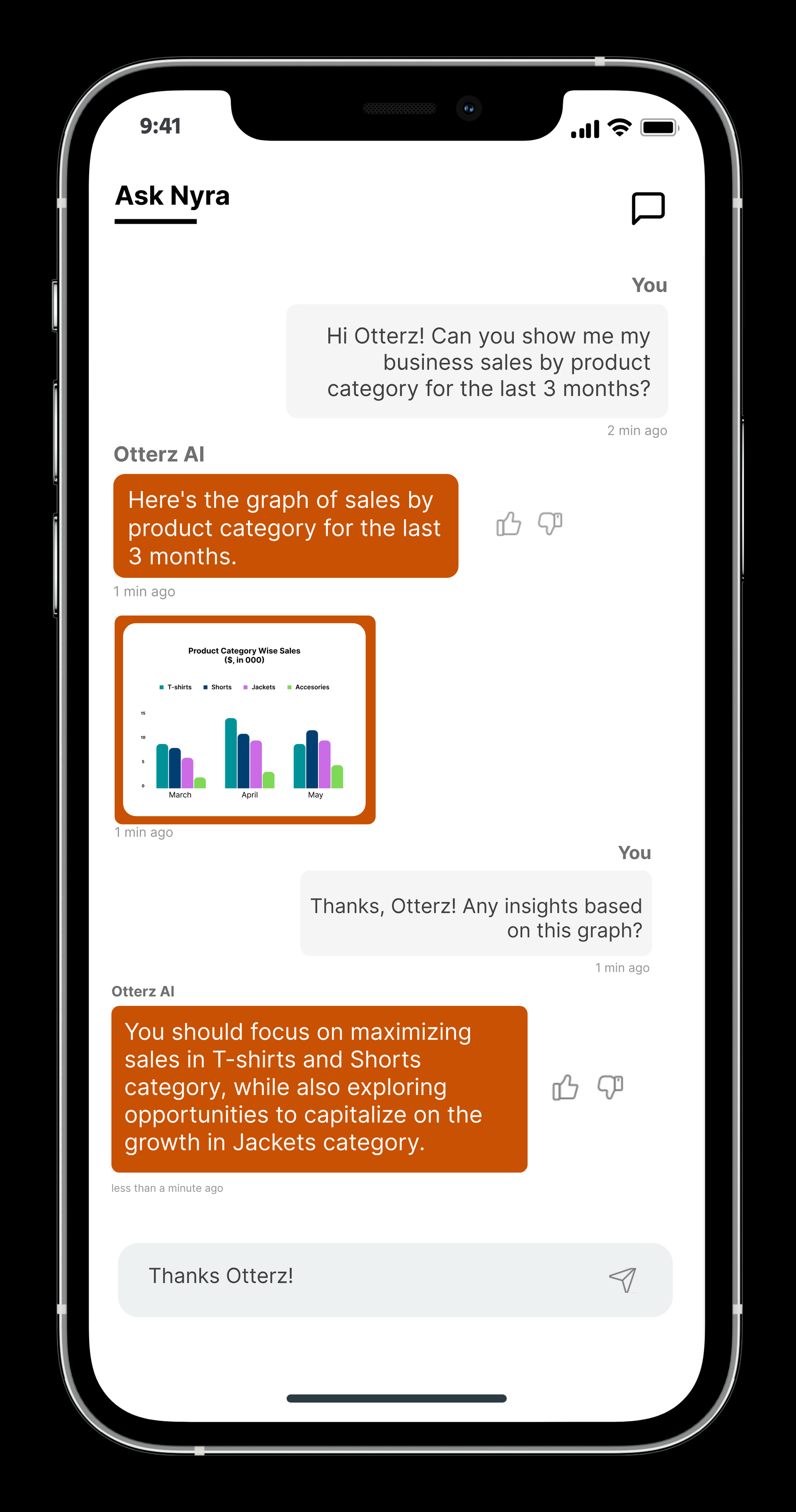

Instant decision-making

With Nyra’s smart technology and advanced features, gain instant clarity on your business for fast, informed decision-making.

Assists your dedicated accountant

Nyra assists your dedicated accountant in reconciling accounts, and classifying transactions to keep your books updated in real-time faster and with higher precision.

Actionable instant insights

Forget hours spent wading through spreadsheets and bank statements. Nyra gives you quick, real-time insights, transforming complex

data into actionable information.

Always available

Nyra’s at your service 24/7, ready to tackle your questions anytime, anywhere.

Get started in three simple steps

Unlock Otterz's advanced AI Accountant technology instantly — seamlessly integrated

and ready to leverage its full power right after onboarding.

Connect your

accounting software

This connection means Nyra is trained on real-time data specific to your business operations, from sales and expenses to cash flow and payment processing.

Connect your

financial accounts

With a few clicks, the Otterz Platform can connect with any bank account at over 12000 financial Institutions in the US, Canada, and Europe.

You're all set

You're now ready dive into Nyra and gain unparalleled insight into your entire business’s finances with the Otterz financial management platform.

Experience the power of our

AI-powered financial management platform

Starting at $399/mo

Contact us now to see how AI-powered accounting

can transform your business.

AI-bookkeeping

Frequently Asked Questions

*Statistical sources: Exploding Topics - 57 NEW AI Statistics (Apr 2024)

Forbes -

How Small Businesses Are Using AI—And How Your Business Can Benefit Too

Small Business and Entrepreneurship Council

-

Small Business AI Survey